Insights and Strategies

The Debt Ceiling: Tempest in a Teapot?

It’s difficult to get through an hour of business (or political) news lately without hearing about the U.S. debt ceiling. While the prospect of the U.S. government running out of cash to repay lenders and make other payments would obviously be a dire and globally impactful event, it would also be an entirely self-inflicted wound. Negotiations are not about if the debt ceiling should be raised, but rather what type of spending constraints the government should be subject to over the next few years and revisions to some previous programs and initiatives. As such, we expect the two sides of the House to reach a compromise and raise the debt ceiling before any significant harm falls on the U.S. (and the global) economy, and importantly, before voters endure any material hardship that might impact their support for their respective elected representatives.

The most recent comments from Treasury Secretary Janet Yellen suggest June 5 as the deadline to effect the ceiling increase. With a tentative deal seemingly moving to both houses of Congresses for approval, by the time this report is published on June 1, the deal may be reached or there may be a temporary solution to continue paying bills for a short period while details on a more permanent deal are hammered out. Irrespective of these outcomes, it is worth noting why the U.S. seems to be going through this process on an almost annual basis and why investors should try to cut through this type of noise and remain committed to well-established long-term investment plans.

How Did We Get Here?

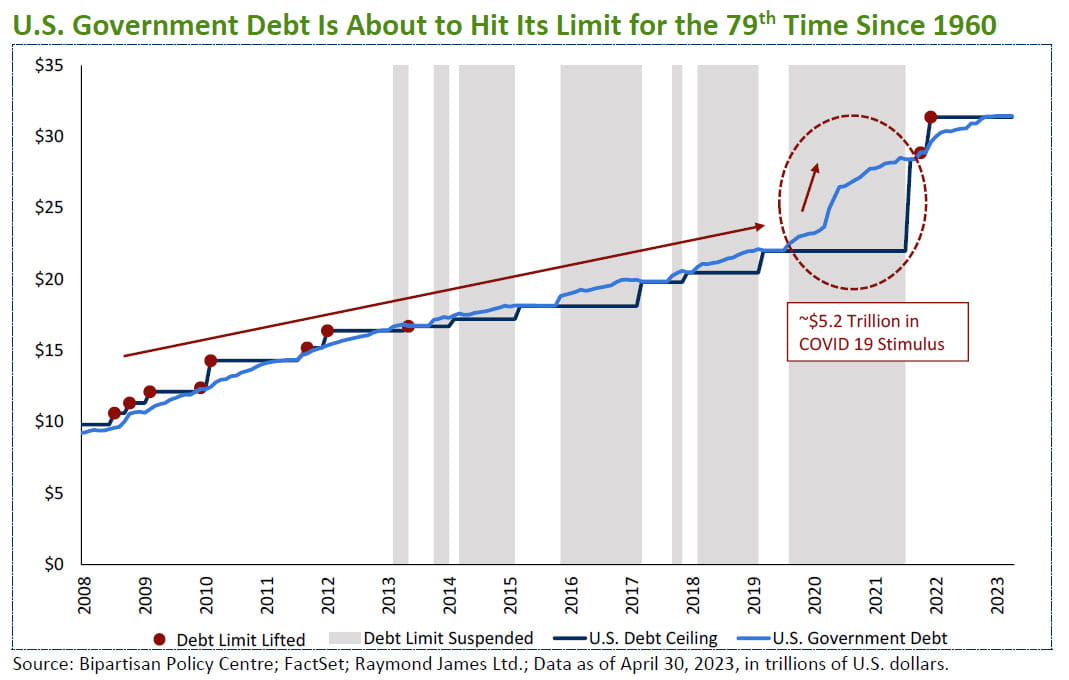

Perhaps a quick history lesson could be useful at this point. In 1917, Congress enacted the Second Liberty Bond Act, which set a limit on how much the U.S. Treasury could borrow. Prior to that, each bond issuance had to be approved with a legislative act. Since then, the debt limit has been increased over 90 times, including 78 times since 1960, or roughly once a year or so, as the country’s borrowing needs grew. Most occurred without much fanfare, but with remarkable flair a few times in the recent past.